unrealized capital gains tax reddit

An unrealized gain is when you have not yet sold the thing. The new proposed tax will be on very very wealthy people.

How Democrats Are Targeting Billionaires With New Wealth Tax Plan Youtube

He uses it on his farm.

. Farmer Bob has a small tractor. If an assets price has increased and you havent sold it yet you have an. Gains or losses are said to be realized when a stock or other investment that you own is actually sold.

If the proposal were. Unrealized Capital Gains Tax. Find out what happens in the.

So a concrete example will help. If elon makes 100 b in unrealized wealth this year from his. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant.

If youre holding stocks or other assets the act of selling them for a profit or at a loss results in gains and losses. Its a tax thing. The idea is that for billionaires only annual gains in wealth would be treated as income.

Normal capital gains tax only applies once you sell it and realize the gain. A realized capital gain occurs when an assets price is higher than you bought it for and you sell the asset. Not to insult anyones intelligence but unrealized capital gains are those youve made on an asset you havent sold yet.

Unrealized gains and losses are also commonly known as paper. Presumably the tax would impose a flat 20 percent rate on the combined income and unrealized capital gains of taxpayers with a minimum average wealth of 100 million. The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year.

They only exist on paper. He bought it for 20000 from a neighbor. What is reddits opinion on an unrealized capital gains tax.

As per article below janet yellen is. Find out more in our article. Reddit Flipboard APV.

Lets try to predict the unintended consequences of a tax on unrealized capital gains by focusing on the very highest UHNWIsthe Elon Musks and Mark. Democrats proposed funding some of their multitrillion-dollar spending plan with a tax on the unrealized capital gains of anyone who makes more than 100 million per year or. So under current law someone whose net worth rose to 22 billion from 20 billion.

The Problems With an Unrealized Capital Gains Tax. You have 100 asset it goes up in value to 200 it goes back down to 100 you have to pax taxes for that. Answer 1 of 18.

The asset doesnt have to be. Ive been seeing the simplified math posts on here. What are unrealized gains.

One Of The Ways Rich People In America Avoid Taxes Entirely Is To Take Loans Against Unrealized Capital Gains Why Can T The Us Just Say Loans Must Be Based On Realized Gains And Property Only R Answers

The Unintended Consequences Of Taxing Unrealized Capital Gains U S Global Investors Commentaries Advisor Perspectives

Biden Capital Gains Hike Would Hit Couples Earning 1 Million

Capital Gains Tax Reform How Proposals Would Affect You

Shadypenguinn On Twitter If This Actually Happens There Is No Clearer Image That America S Systems Are Built To Keep The Rich Rich And The Poor Poor Twitter

Wealth Tax And Unrealized Capital Gains R Theraceto10million

![]()

One Of The Ways Rich People In America Avoid Taxes Entirely Is To Take Loans Against Unrealized Capital Gains Why Can T The Us Just Say Loans Must Be Based On Realized Gains

Unrealized Gains Tax Is Not For You It S For Billionaires Who Never Sell Their Stocks R Superstonk

Opposed To The Unrealized Capital Gains Tax R Elonmusk

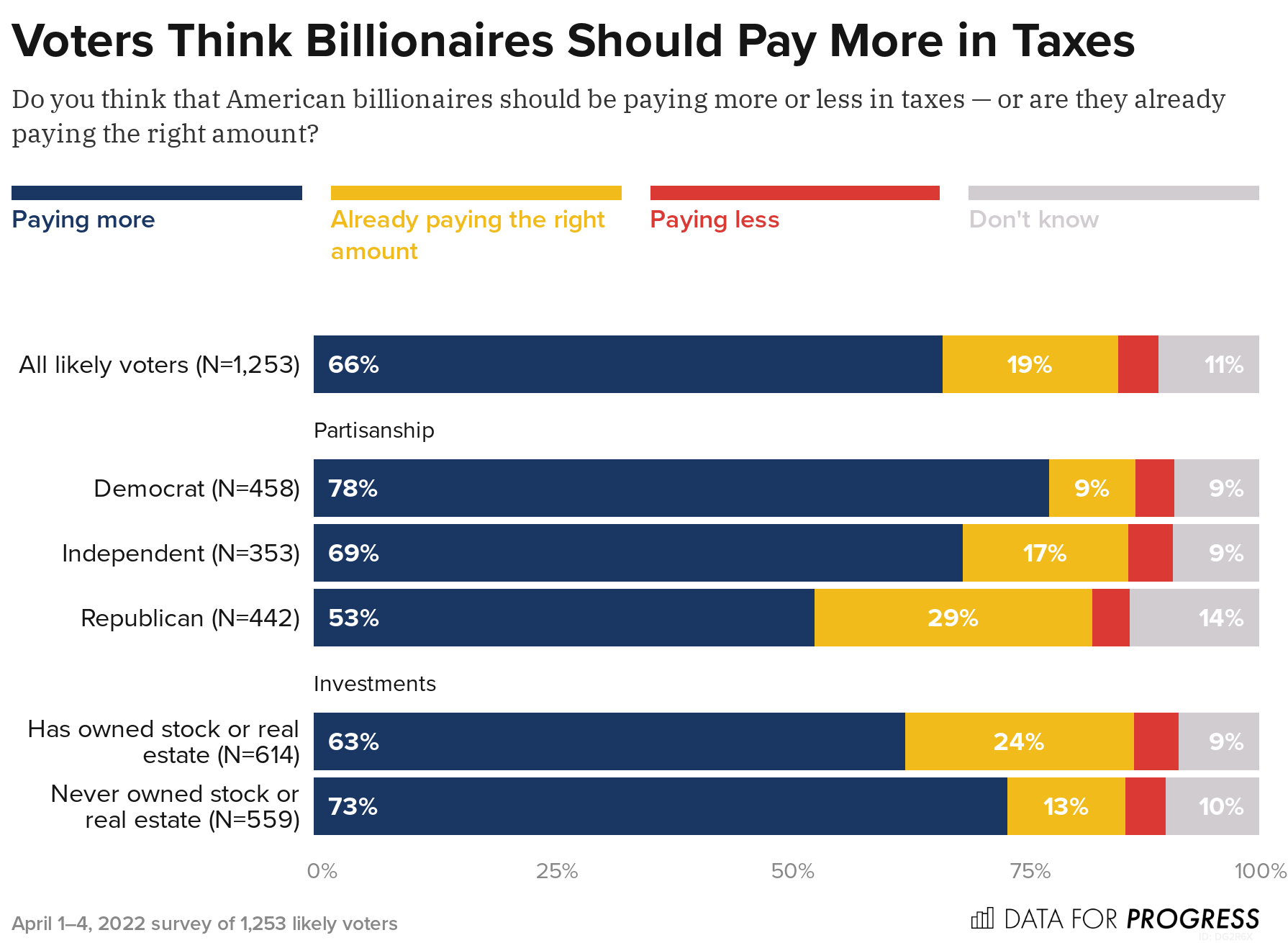

The Billionaire Minimum Income Tax Is Popular

Yellen Describes How Proposed Billionaire Tax Would Work Including Yellen S Proposed Tax On Unrealized Gains In The Stock And Real Estate Market R Wallstreetbets

Biden S Billionaire Tax Proposal Aier

How Is The Unrealized Capital Gains Tax Supposed To Work R Neoliberal

How To Avoid Capital Gains Tax On Stocks With Dividends 10 Ways Dividends Diversify

Pelosi Says Tax On Billionaire Assets Would Pay Just 10 Percent Of Social Spending Bill

Tax Billionaires On Unrealized Stock Gains R Accounting

Overconfident And Uniformed Opinions Are The Bane Of Reddit R Superstonk

Tax Loss Harvesting Capital Gains And Lower Taxes Fidelity

The L Word A Practical Guide To Deducting Cryptocurrency Losses