child tax credit 2021 eligibility

Eligibility requirements have changed for the 2021 Child Tax Credit. Families with a single parent.

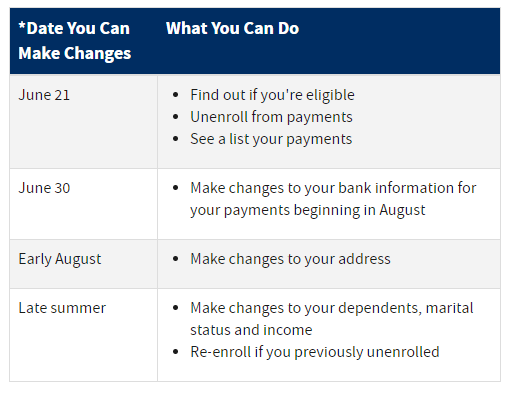

Child Tax Credit 2021 This Is The Last Day To Opt Out Of Payments Fox Business

In the case of Feigh vCommissioner 152 TC No.

. It provides money for basic needs. To Qualify for the Senior Citizen Rent Increase Exemption SCRIE program you must. These people are eligible for the full 2021 Child Tax Credit for each qualifying child.

Complete Edit or Print Tax Forms Instantly. Haworth Summer Recreation 2021. Ad The new advance Child Tax Credit is based on your previously filed tax return.

The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C Medicare Advantage plans. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. 31 2021 the tax credit was increased from 2000 to 3000.

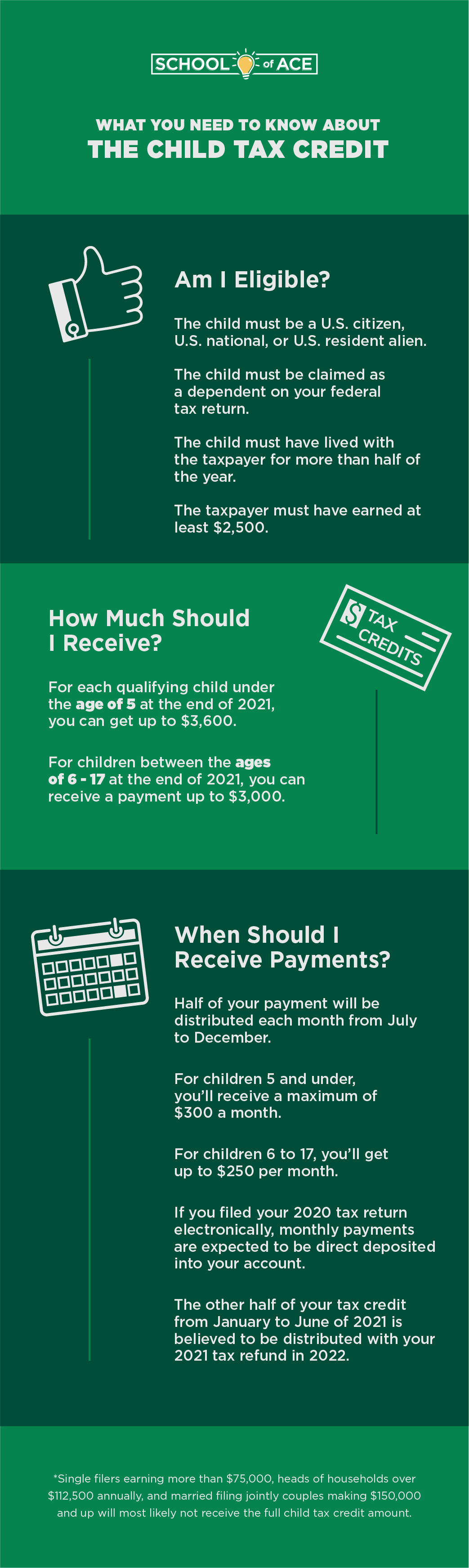

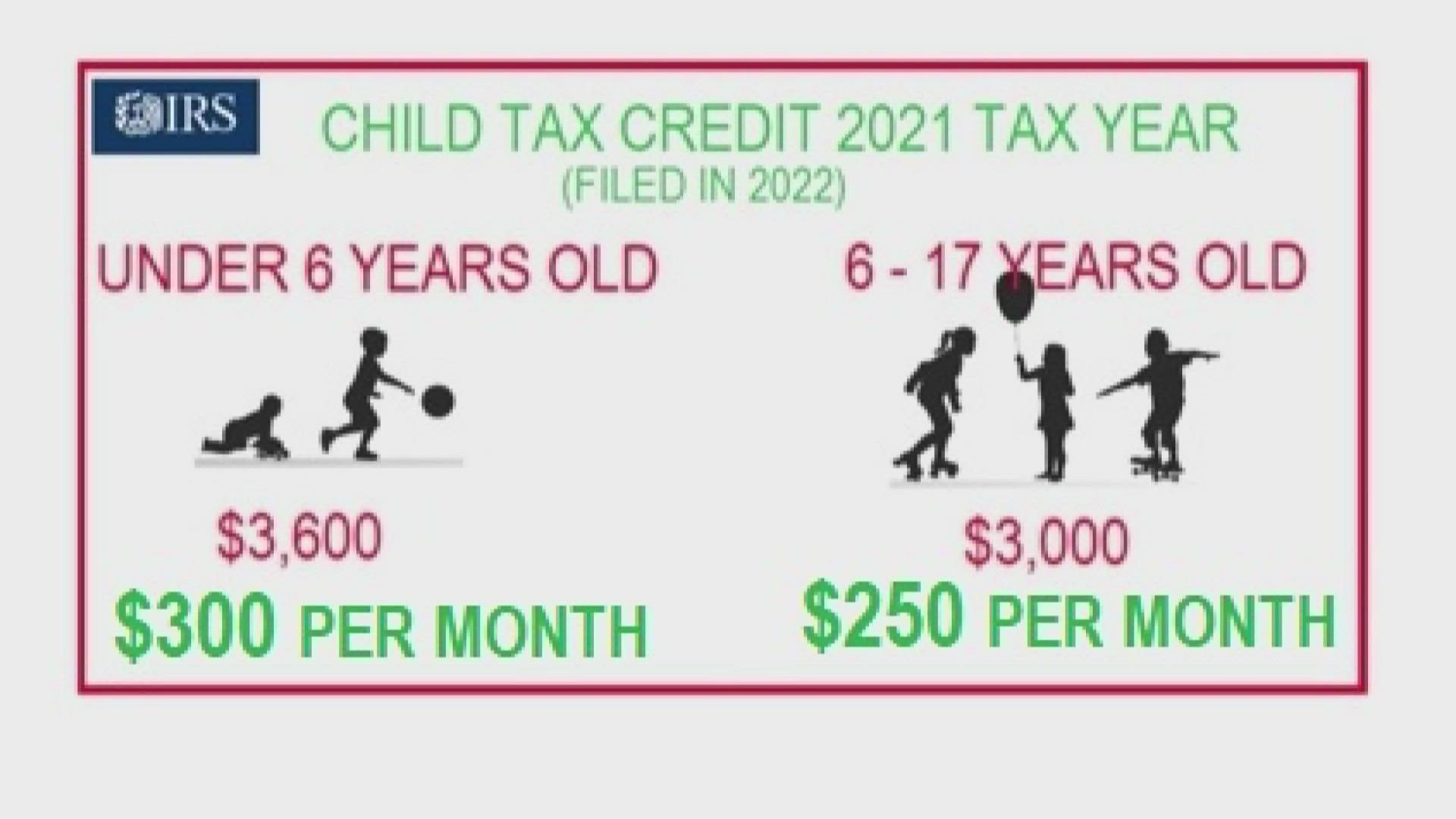

For families to get the full 3600 benefit for newborns theyll need to be patient and take a couple of extra steps. Half of the total amount came as six monthly. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 per child for qualifying children under the age of 6 and to 3000 per child for qualifying.

However the deadline to apply for the child tax credit payment passed on November 15. If you enroll in a Medicare Advantage plan with this benefit the. 911 Memorial Service 2021.

Have a main home in the US. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for. The money comes from general tax revenues.

Why Have Monthly Child Tax Credit Payments Stopped. If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying. Supplemental Security Income is for low or no income individuals who are aged blind or disabled.

Families only received half so they are waiting to receive the other half this. The maximum Child Tax Credit payment was 3600 for each qualifying child up to age 5 and 3000 for each child age 6-17. Eligible taxpayers with their bank account information.

Be the Head of Household as the primary tenant named on the leaserent order or. 15 the IRS was found to have effectively created an unintended double tax benefit for receipt of a Medicaid waiver payment. Property taxes may be paid by credit card debit card and e-check payments via the link on the Haworth.

Ad Access IRS Tax Forms. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically. The expanded Child Tax Credit was worth 3000 for children ages 6 to 17 and 3600 for children under 6 in 2021.

For qualifying children under 6 the tax. A childs age helps determine the amount of Child Tax Credit that eligible. The advance is 50 of your child tax credit with the rest claimed on next years return.

For tax year 2021. Entered the required information in the Economic Impact Payment Non-Filers tool or the new Advance Child Tax Credit 2021 Non-Filer tool. In 2021 the max benefit was 3600 per eligible child under the age of.

There is no minimum. Married couples filing a joint return with income of 150000 or less. Be at least 62 years old.

Parents of 2021 babies can claim child tax credit payments. Discover The Answers You Need Here. The maximum age requirement has been raised from 16 to 17.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600.

Child Tax Credit Children 18 And Older Not Eligible Verifythis Com

Child Tax Credit Worth Up To 300 To Be Released Four More Times This Year See If You Re Eligible The Us Sun

What You Need To Know About The Child Tax Credit

The 2021 Child Tax Credit John Hancock Investment Mgmt

Advanced Child Tax Credit Charlotte Center For Legal Advocacy

Child Tax Credit 2021 Changes Grass Roots Taxes

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

To Reach Every Child The Child Tax Credit Eligibility Requirements Must Be Changed Center For The Study Of Social Policy

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

![]()

Faqs About The Child Tax Credit Green Country Fcu News

Fuller Advance Child Tax Credit Payments

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Kare11 Com

What Is The Child Tax Credit And How Much Of It Is Refundable

Child Tax Credit 2021 When Does It Start Calculator Eligibility And Timeline Marca

Infographic Child Tax Credit Keeps Millions Of Children Out Of Poverty Children S Defense Fund

Information On The Child Tax Credit And Eligibility Newsletter Archive Congressman Jamie Raskin

What To Know About The New Monthly Child Tax Credit Payments